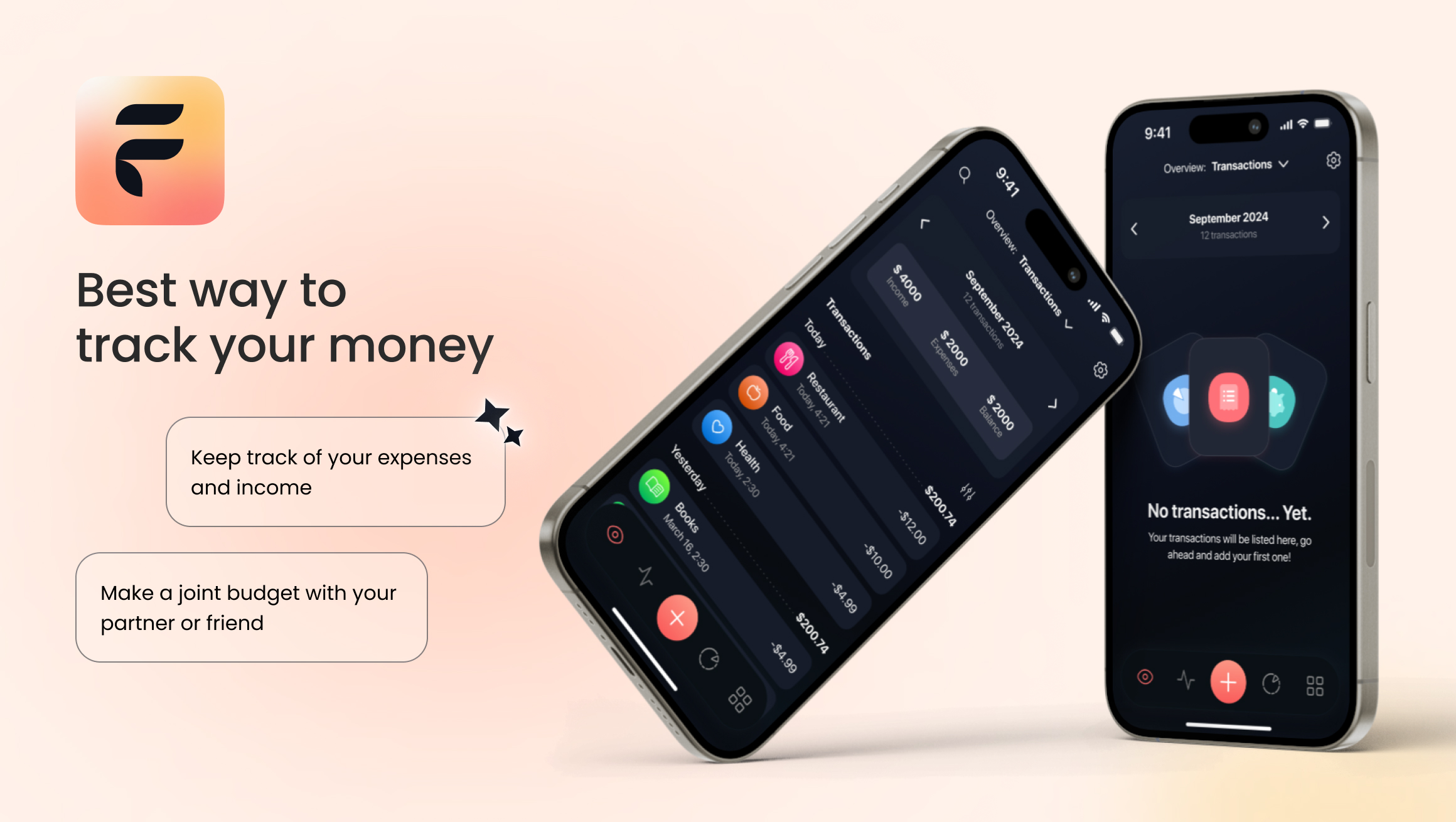

FINWISE – Your Invaluable Financial Assistant for Budget Tracking

About project:

Client Overview:

FINWISE is a personal finance management application designed to assist users in tracking income, expenses, and savings. The platform offers an intuitive interface and advanced features to help users establish and maintain budgets, achieve financial goals, and improve their overall financial well-being.

The target audience for FINWISE includes:

- Young Professionals: Individuals aged 20–35 looking to manage their personal finances and savings.

- Families: Users interested in tracking household expenses and creating joint budgets.

Financially Conscious Individuals: People seeking tools to monitor their spending habits and save effectively.

Services:

Technologies used:

Competitive Advantages

FINWISE differentiates itself through:

- Comprehensive Features: Combining expense tracking, goal management, and detailed analytics in one platform.

- Personalization: Customizable settings, categories, and notifications to suit individual preferences.

- User Engagement: Widgets and notifications that keep users informed and motivated.

- Analytics Dashboard: Advanced visual tools that make it easy to analyze spending and savings trends.

Timeline:

- Research (2 Weeks): Conducted user surveys and competitive analysis.

- Design Process (4 Weeks):

- User Flow Development: Ensured seamless navigation.

- Wireframing: Created initial app layouts for core features.

- UI Design: Focused on a modern, user-friendly aesthetic.

- Development (6 Weeks):

- Built expense tracking, analytics, and goal management features.

- Integrated widgets and notifications for real-time updates.

- Testing and Refinement (2 Weeks): Conducted usability testing with beta users, gathering feedback for iterative improvements.

Challenges

Expense Tracking

- Many users struggled to categorize their expenses and identify areas for savings without a comprehensive tool.

User Engagement

- Ensuring that users remain motivated to track their spending and progress toward financial goals.

Customizability

- Users have diverse financial habits, requiring the app to cater to varying preferences, such as custom categories and transaction tags.

Goal Management

- Providing an intuitive way to set, track, and achieve financial goals tailored to individual needs.

Solutions Implemented

Research and User Flow Development

- Conducted surveys and interviews to understand how users track and manage their budgets. Mapped out user flows to ensure a seamless experience from account setup to expense tracking and goal management.

Expense Tracking and Categorization

- Developed features for both manual and automated tracking of expenses. Categorized expenses into predefined groups (e.g., food, utilities, entertainment) while allowing users to create custom tags.

Detailed Reports and Analytics

- Built an analytics dashboard offering visual representations of financial data through charts and summaries. Enabled users to track their spending habits over time, identify patterns, and spot opportunities for savings.

Financial Goal Tracking

- Added tools for setting and monitoring financial goals, such as saving for a vacation or building an emergency fund. Allowed users to visualize their progress toward these goals with dynamic updates and notifications.

Customizable Settings and Widgets

- Provided options for users to select their preferred currency, categories, and notification settings. Introduced widgets and push notifications to keep users informed of financial milestones and daily updates.

Results

- Improved Financial Awareness:

Users reported a better understanding of their spending habits, with detailed reports helping them identify areas for potential savings. - Enhanced Engagement:

The integration of widgets and notifications significantly increased user retention and engagement. - Streamlined Budget Management:

Customizable budgets and categories allowed users to tailor the app to their specific financial needs. - Goal Achievement:

87% of beta testers successfully set and tracked progress toward at least one financial goal, underscoring the app’s effectiveness in motivating users. - Positive Feedback:

The app received high marks for its user-friendly interface, intuitive design, and powerful analytics.

More Details

Do you want

the same one?

Leave a request and our manager will contact you to discuss your project and give an assessment of a similar project.